Clinical trials form the crux of all regulatory decisions regarding any new health intervention such as drugs and medical devices and thus require to be performed with the utmost care and under the supervision of trained researchers and clinicians. Aside from playing a pivotal role in the fate of an intervention, clinical trials are most often the longest and costliest part of a drug/medical device development program. Therefore, it is not unreasonable to envision that certain countries or regions are better equipped to perform clinical trials than others based on better availability and training of clinicians and healthcare professionals and the availability of resources.

The United States has always been at the forefront of clinical trial research and conduct. Factors that make the U.S. an attractive option for clinical trials include:

- Availability of trained clinicians and professionals from clinical research institutes with experience in clinical trial research

- Collaborations between academic institutions and pharmaceutical companies that allows for funding

- An efficient regulatory system for drug and medical device approval

- High-quality infrastructure, facilities, and resources for the conduct of trials

- Racial and ethnic diversity due to immigration allows for the recruitment of a larger and more diverse patient pool

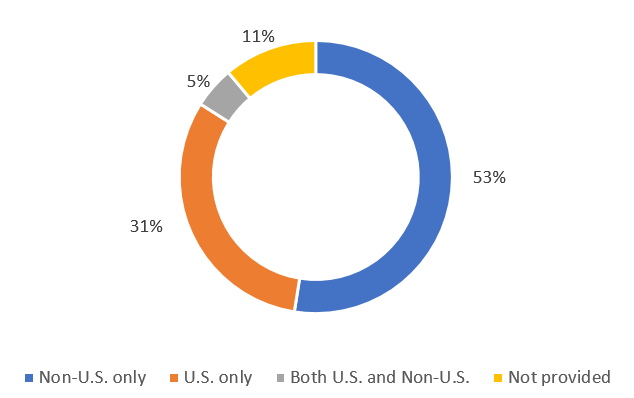

Data from ClinicalTrials.gov, a registry of clinical trials that are run by the United States National Library of Medicine, shows the following distribution of studies registered by location (Figure 1) as of November 2022

Figure 1. Distribution of clinical trials registered as per location (November 2022)

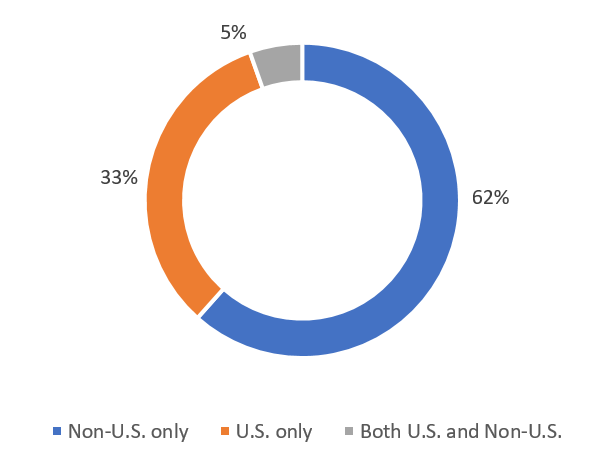

The distribution of recruiting studies by location is shown in Figure 2. Both these figures indicate that the U.S. is the largest single country for trial registration and recruitment.

Figure 2. Number of recruiting studies registered as per location (November 2022)

From 1999-2021, the U.S. also recorded the largest number of trials with a total of 157,618 trials accounting for 23.48% of trials globally as per statistics from the World Health Organization (WHO).

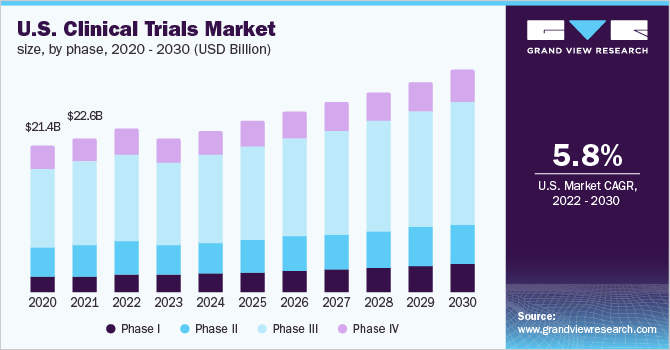

In terms of market size, the U.S. clinical trial market was valued at USD 22.6 billion in 2021 and is expected to increase at a compound annual growth rate (CAGR) of 5.8% from 2022-2030 as per a report by Grand Review Research (Figure 3). In 2021, the U.S. dominated the global clinical trial market with the largest revenue share of 50.7%.

Figure 3. U.S. Clinical trials market size projection from 2020-2030

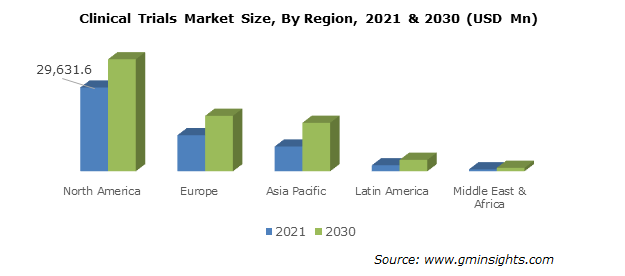

Although there was a slight dip in 2020 due to the COVID-19 pandemic, the U.S. market has recovered. An increase in research and development (R&D) activities, personalized medicine for oncology, vaccine trials, development of virtual and decentralized trial models with remote monitoring capabilities present future growth opportunities for the U.S. market. It is of interest to note that Phase III trials comprise the largest percentage of revenue in the U.S. over the years and will continue to do so in the future due to the large costs associated with the number of trial subjects for this phase. Figure 4 shows the global market size from 2021-2030 showing the U.S. as the dominant player.

Figure 4. Clinical trials market size by region

Analytical and market insight reports have shown that the U.S. dominates the clinical trial landscape globally with several opportunities for growth. Although it is more expensive to conduct trials in the U.S. and fewer participants can raise hurdles for recruitment, the U.S. remains the stalwart clinical trial destination.

References

- Trends, Charts, and Maps – ClinicalTrials.gov

- Number of clinical trials by year, location, disease, phase, age and sex of trial participants (who.int)

- S. Clinical Trials Market Size & Share Analysis Report, 2030 (grandviewresearch.com)

- Clinical Trials Market Share Analysis Report 2022-2030 (gminsights.com)